While the Ukraine crisis may put some strain on the Chinese-Russian relationship, it has also spurred deeper collaboration between them. Based on a shared desire to undermine the United States’ global order, their constructive partnership will not only endure the blowback from the Ukrainian invasion but is likely to expand.

With the world’s attention focused on Ukraine in the weeks since Russia began its invasion of the country on February 24, there has been fervent debate among foreign policy experts on how Russia’s relations with the West will be affected. Officials in Moscow and Western capitals have traded barbs at each other in the media, while sanctions and counter-sanctions have already begun to bite.

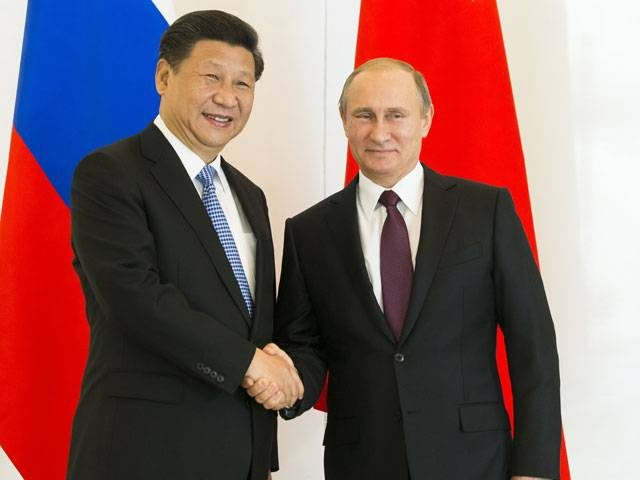

But the effects of Russia’s invasion on Chinese-Russian relations have been far less discussed. In recent years, both Russia and China have publicly promoted their increasingly strong partnership. Chinese President Xi Jinping has called Russian President Vladimir Putin his “best friend,” while both Xi and Putin have described the current state of Chinese-Russian relations as “the best they’ve been in history.”

This has been reflected in collaborative military drills, increasing weapons and energy deals between China and Russia, and public support for one another across their state-run media outlets and their dealings within international organizations like the UN. Since the previous Ukraine crisis in 2014, Moscow has been particularly eager to promote these developments in its relationship with Beijing to limit the effects of diplomatic isolation and economic sanctions imposed by the West.

The current crisis in Ukraine is prompting further efforts by China and Russia to confront the U.S. While Russia’s core interest in doing so is in preventing Ukraine from joining the North Atlantic Treaty Organization (NATO), China is keen to exploit any opportunity that arises during the conflict between Russia and Ukraine that challenges American influence.

The additional sanctions placed on Russia by the West in recent weeks to “cripple Russia’s financial system and hurt its wealthiest citizens” are likely to spur greater investment by China and Russia in developing their own alternatives to U.S.-dominated financial institutions, like the Society for Worldwide Interbank Financial Telecommunication (SWIFT) payment verification system. Russia and China both began to invest in their own international payments systems after several Russian banks were blacklisted from SWIFT in 2014.

These new international payments systems include Russia’s System for Transfer of Financial Messages (SPFS) and the National Payment Card System (now known as Mir), as well as China’s Cross-Border Interbank Payment System (CIPS) and UnionPay. Russian and Chinese banks are active across these platforms, and the number of banks utilizing these alternative systems in Russia and China will only increase as the two countries seek to maintain and “deepen” their business ties and bypass the sanctions by the West.

Encouraging the development of separate financial systems outside Western control will also result in increased participation by so-called “rogue states” in global finance, which are often accustomed to conducting business on the black market.

In early February, just weeks before Russia’s Ukrainian invasion, China and Russia also agreed to a 30-year natural gas deal through a new pipeline. Transactions will be conducted in euros for this deal, which is part of wider efforts by both Russia and China to lower their vulnerability to the U.S. dollar and the threat of sanctions.

After hundreds of Western companies declared their intention to “pull out” from Russia following its invasion of Ukraine, Moscow stated it is looking at nationalizing the infrastructure of these foreign companies and will strip them of patent protections. Western assets and intellectual property rights may be of use to China, which is similarly wary of Western firms operating domestically, and the Chinese also seem intent on challenging these firms globally.

The current escalation in Ukraine has also reinforced diplomatic support between Beijing and Moscow, including a Chinese abstention from the UN General Assembly vote on March 2 to condemn Russia for its Ukrainian invasion. China’s state-run media outlets have also promoted Russia’s views on the war on Facebook and Instagram after Russia’s media outlets were banned by several Western countries, and it has also supported Russia’s claims of the U.S. “financing biological weapons labs in Ukraine.”

While still short of an official alliance, the announcement by Moscow and Beijing of a “no limit[s]” partnership made on the opening day of the 2022 Winter Olympics in Beijing in February has shown that Russian and Chinese interests have increasingly converged. China also “endorsed a Russian security proposal” to exclude Ukraine from joining NATO through a statement made by Xi with Putin on February 4, according to the New York Times, and there is no doubt that China received a warning from Moscow that it was planning an invasion of Ukraine within the coming weeks after this statement was made.

However, the current flareup in Ukraine has exacerbated larger global economic instability, and several immediate and longer-term consequences stemming from the Russian invasion may cause some strain to the China-Russia partnership.

For example, Ukraine is a major corn exporter to China. With food prices rising globally, even before the Russian invasion, the Russian offensive has already had negative effects on China’s food security. While Russia is also a major food exporter to China, Russian Prime Minister Mikhail Mishustin signed an order on March 14 that banned grain exports to Eurasian Economic Union (EAEU) members, indicative of the difficulty Russia is facing in meeting foreign food export demands even to close Russian allies.

China is also highly dependent on energy imports from other countries. In comparison to Russia or the U.S., it is far less able to influence the price of resources and far more vulnerable to energy disruptions. While Russia may be able to help meet the Chinese energy demand, the current spike in prices will likely accelerate China’s push for energy self-sufficiency, removing a vital pillar of the Chinese-Russian relationship.

And in a rare public display of frustration toward China, a Russian official admitted that China refused to supply Russia with aircraft parts after Russia repossessed roughly $10 billion in Boeing and Airbus planes. China’s dismissal showed a clear hesitation to risk a wider confrontation with the West despite Russia’s increasing brinkmanship.

China is also wary of being perceived as enabling Putin, and Russia’s heavy-handed approach in Ukraine has attracted more attention to Taiwan’s security. Since the Third Taiwan Strait Crisis in 1995, Beijing has been avoidant of confronting the U.S. militarily. Aside from limited skirmishes in its border regions with India, China has preferred using its economic power rather than its military to pressure other countries into submission in recent decades.

But China’s assistance to Russia will raise fears among China’s neighbors with their own disputes with Beijing. This support being provided to Russia by China could be enough to galvanize coordinated regional antagonism toward Beijing, supported by a heightened U.S. military presence in the Asia-Pacific region.

Despite these real and potential consequences, the Russian invasion of Ukraine has already instigated greater cooperation between China and Russia—a trend that will only continue. Russia’s need to shore up its situation may have expanded China’s leverage over it, but both Beijing and Moscow are well aware of the need to work together to undermine the U.S. dominance in world affairs—and they see the wider global instability resulting from the conflict in Ukraine as an effective way to do so.