The May report is mostly bad news. The jump in energy and food prices were expected, nonetheless it will hit consumers hard. It seems likely that the rise in interest rates and slower growth will reverse price increases in more areas soon, notably cars, but it has not happened yet. Soaring energy and food prices, largely due to the Ukraine war, will continue to be huge problems. A cease fire could make a big difference.

Rents are still rising rapidly. The Fed’s rate hikes have likely already slowed or reversed the rise in sale prices, but it will be a while before any effect can be seen in rents.

It is disappointing that new and used vehicle prices rose sharply. The latter was inconsistent with the Manheim Used Vehicle index, which showed a much smaller rise.

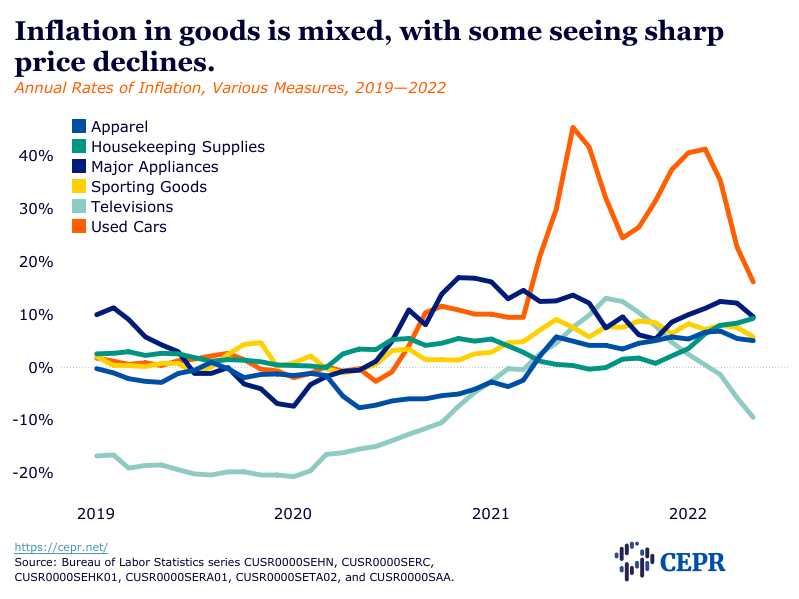

There was a mixed story with other items: TV and appliance prices fell sharply, reflecting the glut facing retailers, but apparel prices rose again.

On the good news side, medical services inflation seems to be slowing. Also, restaurant prices are rising far less than food prices, so labor costs are not the driving factor.

Overall inflation was up 1.0 percent in May; core was up 0.6 percent; energy was up 3.9 percent, and food was up 1.2 percent.

New vehicle prices jumped 1.0 percent in May and used vehicles rose 1.8 percent, reversing drops in the prior three months. Car insurance rose 0.5 percent in May, up 4.5 percent year-over-year. This is largely reversing the pandemic declines; prices are now up 3.4 percent from the February 2020 level.

Apparel prices rose sharply — a 0.7 percent rise mostly reversed a 0.8 percent decline in April. It seems that inventory gluts reported by major retailers have not yet affected prices in May.

Appliance prices fell 0.7 percent in May after dropping 0.5 percent in April but are still up 6.4 percent year-over-year. Appliances are likely to follow the path of TVs. After rising sharply last year, prices have been falling since September. They dropped 3.0 percent in May and are now down 9.5 percent year-over-year.

Rent and owners’ equivalent rent are both up 0.6 percent in May. They are up 5.2 percent and 5.1 percent year-over-year, respectively.

Inflation in restaurants continues to trail food inflation, rising 0.7 percent in May, compared with 1.4 percent for food at home. The year-over-year increase in restaurant prices has been 7.4 percent, compared with 11.9 percent for food at home.

Inflation in medical care services moderated to 0.4 percent in May, down from 0.6 percent in March and 0.5 percent in April. Roughly half of the May increase is due to a 2.0 percent rise in the index for health insurance.

Airfares and hotel prices both rose sharply in May by 12.6 percent and 0.9 percent, respectively. The year-over-year increases have been 37.8 percent and 19.3 percent, adding 0.2 and 0.18 percentage points to the year-over-year inflation. Airfares are now 24.6 percent above pre-pandemic levels and hotels 14.3 percent.

College tuition was up 0.1 percent in May, 2.1 percent year-over-year.