We have published our estimates of OPEC production capacity and surplus capacity every month since 2002 in our Short-Term Energy Outlook (STEO). This data series is a useful indicator of global oil market tightness. Large surplus production capacity numbers suggest that OPEC has restrained crude oil production in the past to avoid over-supplying markets, which would result in large inventory builds and lower prices.

We are now extending our annual crude oil surplus capacity estimates for current OPEC members back to 1970, and we have also added estimates for non-OPEC countries (including both former members of OPEC as well as non-OPEC countries). This extended data series provides historical context for analyzing current market conditions.

The new annual surplus capacity data series is based almost entirely on EIA data, including our International Energy Statistics (IES) production data, STEO, and our International Energy Outlook (IEO) and uses a consistent definition of capacity throughout the time series (effective production capacity).

Summary of Findings

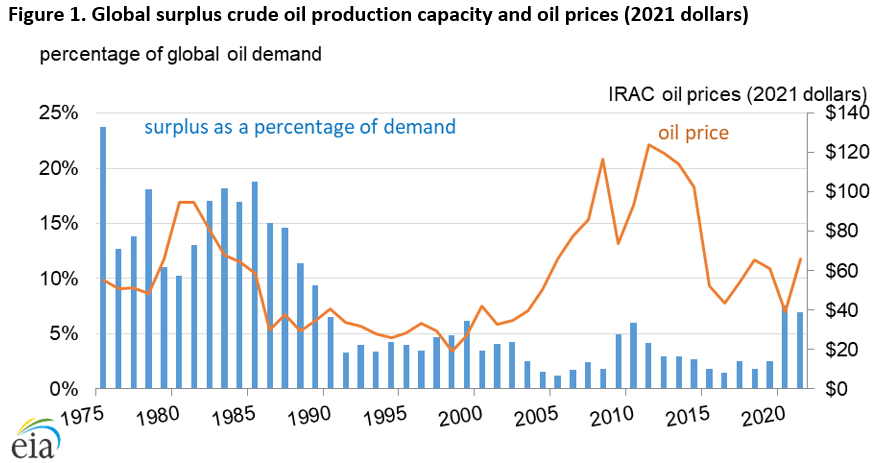

Although many factors affect oil prices, the availability of surplus capacity has historically been linked to oil market tightness and changes in global oil prices, in part, because OPEC producers tend to withhold crude oil production during periods of low demand and when prices fall. Oil prices also react to perceived low levels of surplus production capacity. The oil market closely monitors the availability of surplus production capacity to meet either supply shortages from oil market disruptions or forecast increases in global oil demand.

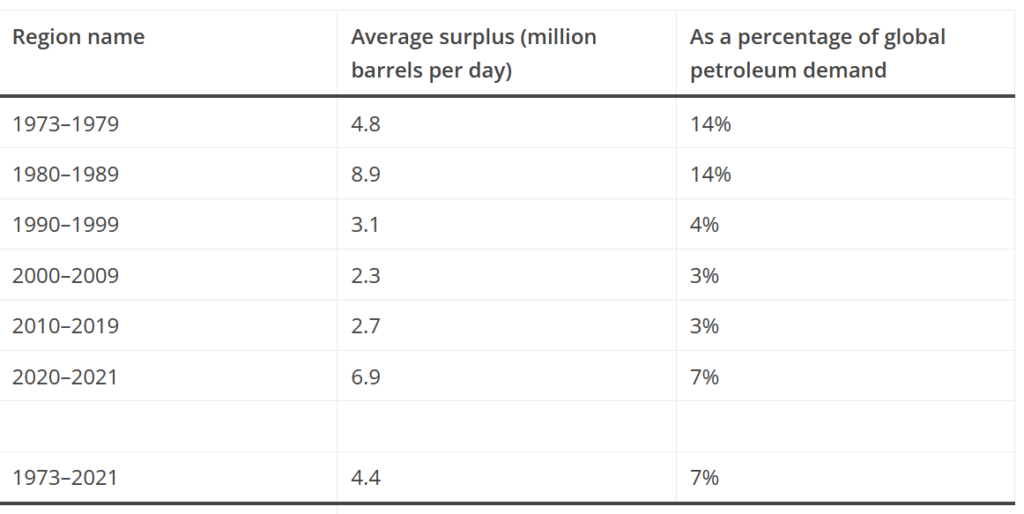

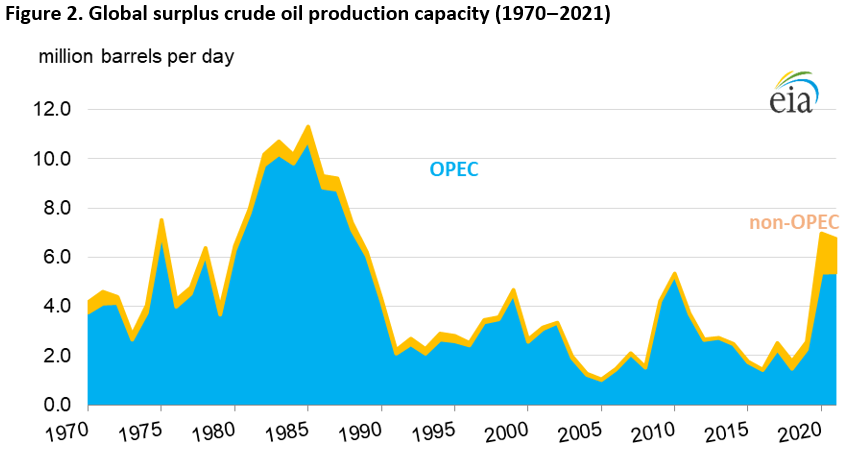

Surplus capacity has varied over time, and it peaked at over 11.3 million b/d in 1985, the year after Saudi Arabia formally ended its role as swing producer for OPEC.

Surplus capacity between 1990 and 2015 peaked at 5.3 million b/d. It was not until 2020 and 2021 that surplus capacity rose above the previous 25-year peak, which was the result of both reduced oil demand following the global onset of the COVID-19 pandemic and OPEC+ production cuts.

Of the 7.0 million b/d of surplus capacity in 2020, 1.6 million b/d came from non-OPEC partners, the majority of which came from Russia.

Production cuts by non-OPEC countries prior to the OPEC+ cuts beginning in 2017 did not result in any significant surplus production capacity.

Methodology

Surplus production capacity estimates for OPEC countries

The surplus capacity data series relies almost entirely on existing EIA data on global oil production and production capacity.

Although non-EIA data series exist for some of the years in this time period, using our existing data series was advantageous because:

We collected the data in these series, which means they have consistent definitions.

These data are official EIA estimates.

We had already published much of the data.We first standardized all of the data we used in our calculations to a consistent basis using total petroleum liquids. We standardized the data series because our published production capacity data prior to 2003 included total petroleum liquids, but the 2003–2021 production capacity data published in the STEO were for crude oil only and exclude condensate. For consistency, we calculated a uniform 1970–2021 capacity series for total petroleum liquids. We used this approach because it was straightforward to add non-crude oil liquids production to the 2003–2021 crude oil capacity data to derive total petroleum liquids capacity rather than to exclude from them from crude oil estimates.

We estimated surplus production capacity by subtracting total petroleum liquids production from the revised petroleum liquids production capacity series. This surplus capacity series is consistent with the series for crude oil surplus capacity because we don’t attribute any surplus capacity to other petroleum liquids. Surplus capacity arose almost exclusively from the OPEC/OPEC+ production agreements that resulted in cutbacks to only crude oil production.

Our estimates of surplus crude oil production capacity do not include volumes of oil that are offline because of unplanned outages and disruptions, including sanctions, because these volumes cannot be brought back voluntarily.

Our petroleum liquids production data serve as an important consistency check for the official, or published, capacity estimates. Over the years, we have revised the IES production estimates, and in some cases, they have exceeded the initial production capacity estimates. In addition, the production estimates serve as a guide for resolving inconsistencies in the capacity data. For example, production increases or decreases should generally follow movements in the production capacity series unless external factors such as production disruptions or changes in OPEC production targets are present.

Surplus production capacity estimates for non-OPEC countries

Generally, only OPEC/OPEC+ countries hold surplus production capacity because other non-OPEC countries generally produce as much as market conditions allow. If a country’s production is disrupted, the disrupted capacity does not meet the definition of surplus production capacity because the producing country cannot bring that production back at will. However, on a few occasions, non-OPEC producers have produced below capacity levels voluntarily.

The November 2016 OPEC+ agreement set production targets for not only most of OPEC producers, but several partner countries as well. Beginning in January 2017, nine non-OPEC producers joined with OPEC countries to lower production as part of that OPEC+ production agreement. These targets were adjusted at subsequent OPEC+ meetings. Mexico also agreed to voluntarily lower production, but OPEC did not assign it any formal production targets.

On two occasions during the 1970s and 1980s, the United States held small amounts of surplus production capacity. Texas held 100,000 b/d–215,000 b/d of surplus capacity in 1970–1971 because the Texas Railroad Commission regulated production volumes until March 1971. In addition, U.S. stripper wells were reportedly shut in voluntarily after oil prices fell sharply following Saudi Arabia’s decision to stop acting as the swing producer in 1985. The IEO tables include non-OPEC production and capacity, and the IEOs for 1985–1987 note that the United States had the ability to increase capacity by 100,000 b/d by re-opening these wells, which is no longer the case. The United States does have a number of drilled but uncompleted wells (DUCs) that could affect the size and timing of a domestic supply response to a rise in oil prices, but these are not counted as surplus capacity because they were never completed.

Because non-OPEC countries traditionally produce at capacity, we estimated their surplus capacity for 2017–2020 by comparing pre-OPEC+ agreement production levels with subsequent production averages. Our analysts then examined these estimates of surplus capacity to look for other factors that may have affected capacity and production, such as disruptions. These analysts produced the estimates of surplus capacity for 2021.