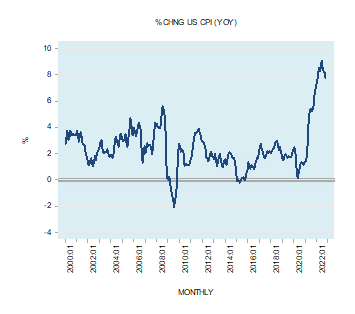

The yearly growth rate of the Consumer Price Index (CPI) fell to 7.7 percent in October from 8.2 percent in September. Note that in October 2021 the yearly growth rate stood at 6.2 percent.

Some experts are of the view that it is quite likely that the momentum of the CPI might have peaked.

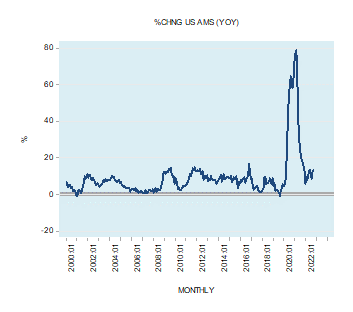

We suggest that the decline in the yearly growth rate of the CPI is from the sharp decline in the momentum of money supply. The yearly growth rate of our monetary measure for the US stood at almost 80 percent in February last year against 13.5 percent in February this year (see chart).

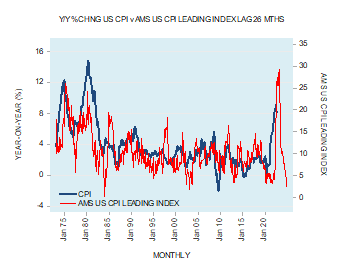

Because of the time lag between changes in money supply and changes in the CPI, it is quite possible that the yearly growth rate of the CPI is poised for a visible decline ahead (see chart).

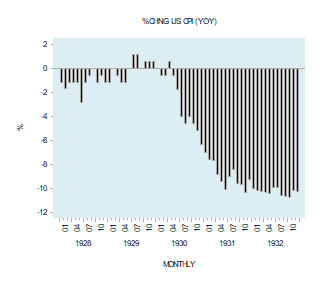

If this were to eventuate, then the decline in the yearly growth rate in the CPI raises the likelihood that many commentators will start warning about deflation—i.e., a general decline in the prices and the threat that it is going to pose to the economy.

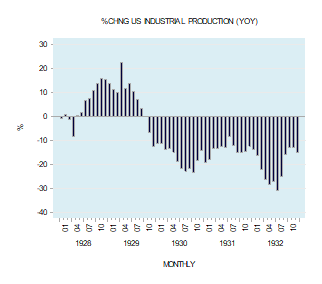

A general decline in the prices of goods and services is regarded as bad news, since it is associated with major economic slumps such as the Great Depression. In July 1932, during the Great Depression, the yearly growth rate of industrial production stood at –31 percent while by September 1932 the yearly growth rate of the CPI closed at –10.7 percent (see chart).

Deflation is a major concern to many commentators. When prices fall, it is harder for borrowers to pay down existing debts, leading to growing defaults, while banks become reluctant to extend credit.

Most economists and financial experts regard a general fall in prices as always bad news for it slows down spending, which in turn undermines investment in plant and machinery. These factors, experts claim, lead to an economic slump. Moreover, as the slump further depresses the prices of goods, this intensifies the pace of economic decline.

This is why most economists believe the central bank should prevent deflation. In his November 21, 2002, speech before the National Economists Club entitled “Deflation—Making Sure ‘It’ Doesn’t Happen Here,” Ben Bernanke, then a Fed governor, laid out how the central bank could combat deflation, such as buying longer-maturity Treasury debt.

In a free market, the rising purchasing power of money through declining real prices is the way a great variety of goods become accessible to many people. On this Murray Rothbard wrote: “Improved standards of living come to the public from the fruits of capital investment. Increased productivity tends to lower prices (and costs) and thereby distribute the fruits of free enterprise to all the public, raising the standard of living of all consumers. Forcible propping up of the price level prevents this spread of higher living standards.“

Even accepting that declines in prices in response to an increase in the production of goods promote the well-being of individuals, why are declining prices associated with a decline in economic activity? Experts claim this type of deflation is bad and must be opposed.

Why Central Bank Monetary Pumping Makes Things Much Worse

Through loose monetary policy, the central bank creates a class of people who unwittingly become consumers without contributing to the pool of wealth. The consumption by those receiving newly created money comes through the diversion of wealth from wealth producers.

Not only does the easy monetary policy push the prices of existing goods higher but the monetary pumping also gives rise to the production of goods or assets demanded by non–wealth producers. While the pool of wealth grows, goods and services that are patronized by non–wealth producers appear to be profitable. Once the central bank reverses its loose monetary stance, the diversion of wealth from wealth producers to non–wealth producers is arrested.

Through loose monetary policy, the central bank creates a class of people who unwittingly become consumers without contributing to the pool of wealth. The consumption by those receiving newly created money comes through the diversion of wealth from wealth producers.

Not only does the easy monetary policy push the prices of existing goods higher but the monetary pumping also gives rise to the production of goods or assets demanded by non–wealth producers. While the pool of wealth grows, goods and services that are patronized by non–wealth producers appear to be profitable. Once the central bank reverses its loose monetary stance, the diversion of wealth from wealth producers to non–wealth producers is arrested.

This, in turn, undermines the demand of non–wealth producers for goods and services, exerting downward pressure on their prices. A tighter monetary stance that undermines activities that sprung from previous loose monetary policy halts the bleeding of wealth generators.

The reduction in prices comes in response to slowing impoverishment of wealth producers, beginning the economic healing. As a rule, however, the central bank tries to stabilize the so-called price index. The “success” of this policy, however, hinges on the state of the pool of wealth. As long as the pool of wealth is expanding, reversing the tighter stance creates the illusion that the loose monetary policy is the right remedy because the loose monetary stance renews the flow of wealth to non–wealth producers, props up their demand for goods and services, halting or even reversing the decline in prices.

Furthermore, since the pool of wealth is still growing the pace of economic growth remains positive. Hence the mistaken belief that a loose monetary stance that reverses a decrease in prices is the key in reviving economic activity. The illusion that monetary pumping keeps the economy going is shattered once the pool of wealth declines.

Once this happens, the economy begins its downward plunge. The most aggressive loosening of monetary policy will not reverse this plunge. Even if loose monetary policies were to succeed in lifting prices and inflationary expectations, this could not revive the economy while the pool of wealth is declining.

What Is the Present State of the Pool of Wealth?

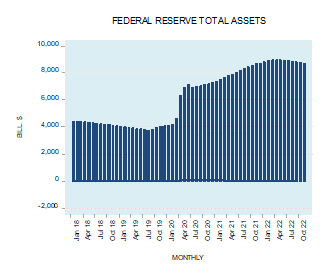

It is possible to establish qualitatively whether the pool of wealth is still expanding or declining. Now, the Fed for many decades pursued aggressive monetary pumping. This coupled with the reckless fiscal policies of the government has likely inflicted severe damage to the process of wealth generation (see charts).

In addition, one should consider the impact of the lockdowns due to covid, which resulted in consumption without any support from production. We suggest that all this raises the likelihood that the pool of wealth is declining.

If this is the case, then a weakening in the wealth generation process implies a severe economic slump ahead. This also raises the likelihood that the uptrend in the ten-year Treasury bond’s yield since July 2020 will continue (see chart).

Any reduction in the momentum of the CPI is expected to work toward a temporary lowering in the yields. However, the increase in individuals’ time preferences is likely to counter this decline.

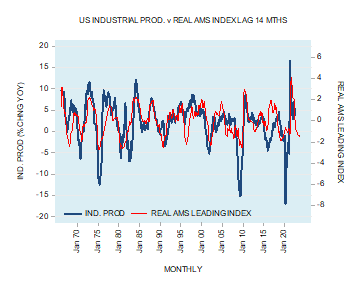

A countereffect to the rising time preference may be the upcoming response by Fed officials who embraced former Fed’s chairman Ben Bernanke theory of the financial accelerator—which suggests that various causes such as a sudden decline in economic activity could trigger a widely spread reaction that could lead to a large economic slump. If this were to occur, then it is likely that the Fed will step in with aggressive monetary pumping and lowering of interest rates. Based on our monetary analysis we expect a visible decline in the momentum of economic activity ahead (see chart).

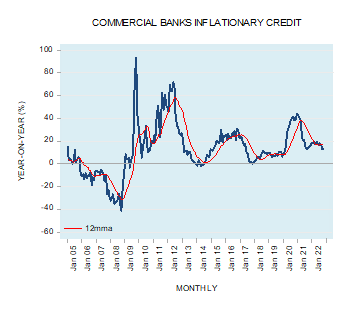

Furthermore, a continued deterioration in economic conditions is likely to undermine commercial banks’ inflationary lending. This in turn is going to weaken the yearly growth rate in money supply. A likely decline in the momentum of money supply is going to severely undermine various nonproductive activities. Needless to say that a decline in the pool of wealth accompanied by a sharp decline in money supply is also going to severely undermine equity markets.

Conclusion

Contrary to the popular view, deflation is always good news for the economy. When prices decline in response to the expansion of wealth, this means that people’s living standards are rising. Even when prices decline because of the bursting of a financial bubble, which is a product of prior money creation, this also is good economic news, for it indicates that the impoverishment of wealth producers is being stopped.

We suggest there is a growing likelihood that the pool of wealth is declining. This raises the likelihood that the uptrend in the long-term interest rates may stay intact. This also raises the likelihood that the stock markets will remain under pressure.