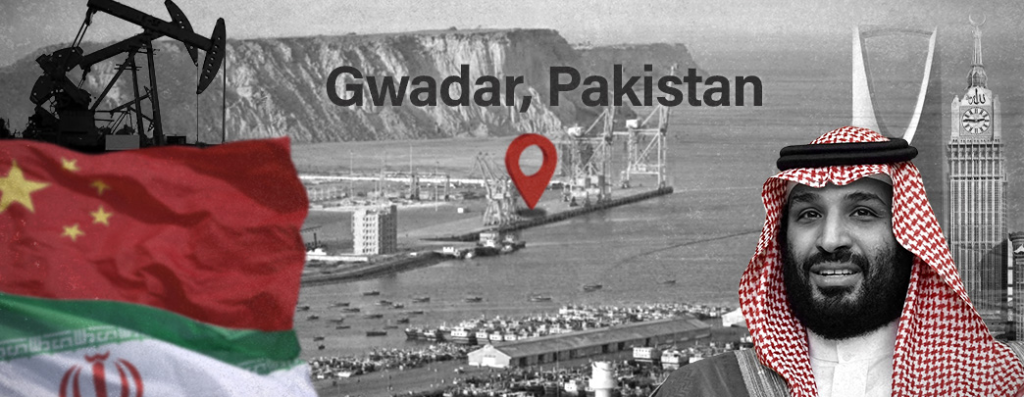

Riyadh’s interest in Pakistan’s Gwadar port is of particular concern for Tehran and its vital oil trade with China.

A $10 billion Saudi Aramco refinery is being built near the port city of Gwadar in Pakistan, about 169 kilometers (km) east of Iran’s Chabahar port in the western Sistan and Balochistan province.

Although some recent geopolitical events have dampened the prospects of Saudi Arabia’s investment initiative at the doorstep of its bitter rival Iran – with whom Riyadh is involved in several regional proxy wars – Pakistani officials and politicians are quite upbeat about the Saudi push.

The fact that Saudi funds are still flowing into the coffers of ultra-conservative, anti-Shia madrassahs in Pakistan’s volatile Balochistan province adds a layer of complexity to the Saudi plan to build a refinery in Iran’s backyard.

While Iranian authorities have not yet responded to Riyadh’s potential involvement in Gwadar – a port city close to Iran’s 800 km-long eastern border with Pakistan – some experts believe any Saudi involvement in the port will irk Tehran over the kingdom’s growing presence near its borders, and the threat that poses.

Challenging Iran’s oil trade with China

Following the reimposition of sanctions on Iranian oil shipments by former US President Donald Trump in 2018, China became the largest consumer of Iranian petroleum products.

According to estimates from three tanker trackers, China’s oil imports from Iran reached a peak of 700,000 barrels per day (bpd) in January 2018, exceeding the peak of 623,000 bpd that Chinese customs had previously reported in 2017 before the US sanctions. From November through December 2021, imports averaged 780,000 bpd, according to one tracker.

It has been suggested that Beijing’s dependency on Iranian oil for energy will be greatly reduced thanks to the Saudi Aramco Refinery. The Saudi investment may therefore aid in the development of an oil city in Gwadar, denying Iran access to its main market for oil exports.

Riyadh hopes that the 80,000-acre oil metropolis will make it much easier for crude to flow from the Persian Gulf to Chinese ports via Gwadar, which will significantly reduce the time it takes to transport Saudi oil to China.

Majyd Aziz, President of UN Global Compact and a former president of the Karachi Chamber of Commerce and Industry (KCCI), does not agree that the Saudi refinery in Gwadar would deprive Iran of a substantial regional oil market.

Aziz told The Cradle that the likelihood of Saudi investment in Gwadar was extremely remote, and that even if this refinery was constructed in three years, Iran would not incur a financial loss because its oil would still be marketed in Afghanistan and Pakistan.

“For Iran, the establishment of a refinery in Gwadar is irrelevant because oil from Iran is subject to United Nations economic sanctions. Regarding the Refinery’s possible exports to China, only an assumption has been made. The bilateral trade between China and Iran should not be evaluated solely based on a single commodity,” explains Aziz.

Washington’s Reaction

Although critics assert that Washington may back the Saudi effort allegedly intended to stop Iranian oil from reaching China, the US response to the Saudi investment in the Aramco refinery project remains subject to speculation, especially in light of the strained relations between Riyadh and Washington over oil production levels.

With regard to Iran’s oil trade with China, last month the Biden administration announced that it had imposed sanctions on two Chinese companies, M/s Zhonggu Co and M/s WS Shipping Co, for transporting and storing Iranian oil – to increase the pressure against Tehran.

According to the State Department, the Chinese firms that the US administration had singled out operate a storage facility for Iranian crude oil and own shipping vessels that transport Iranian petroleum products.

The Treasury Department also identified eight additional firms with headquarters in Iran, India, the UAE, and Hong Kong as sanctions violators. Officials in the Biden administration have expressed concern for more than 18 months that talks to limit Iran’s nuclear program may have reached a stalemate. As such, these actions show that they have started looking for new ways to put pressure on the Islamic Republic’s resolute leadership.

Nearing finalization

According to a Gwadar Development Authority (GDA) official who spoke to The Cradle on the condition of anonymity, the feasibility study for the Saudi project is currently underway and will be completed in the coming months.

“It will take five to six years for the Aramco Oil Refinery to start production. The refinery will also be outfitted with a petrochemical complex to produce polyethylene and polypropylene for Pakistan’s petrochemical industry. The refinery will have the capacity to produce 250,000 to 300,000 bpd,” the official said.

He also claims that Saudi Prime Minister and Crown Prince Mohammad bin Salman (MbS) is slated to pay an official visit to Pakistan toward the end of December to finalize the proposal and launch it officially.

Pakistan’s Federal Minister for Planning and Development Ahsan Iqbal told The Cradle that both Pakistan and Saudi Arabia had already agreed to the investment proposal and that there are no obstacles in the way of the project’s completion.

“Regarding the timing of the Saudi Crown Prince’s visit to Pakistan, our knowledge is significantly lacking. When he arrives in Pakistan it will likely depend on when he can break away from his schedule. However, we would like him to arrive as soon as possible, as he must sign the investment documents before the remaining formalities can be completed,” Iqbal cautioned.

A rival to Saudi leadership in the Muslim world

The Aramco refinery project has seen many ups and downs since 2019, when Saudi Arabia and Pakistan signed seven investment agreements worth $21 billion, including the deep-conversion oil refinery, during MbS’s visit to Islamabad.

In 2020, Riyadh and Islamabad developed serious differences over the Organization of Islamic Cooperation (OIC) ministerial meeting. Pakistan wanted the Kashmir issue to be on the OIC’s agenda, but Riyadh was dragging its feet on the issue. The project was put on hold when those difference intensified, and Riyadh prematurely demanded the return of its $3 billion loans.

Tensions between Riyadh and Islamabad flared up further when Islamabad announced support for an alternative Muslim summit meeting hosted by Malaysia and Turkey in Kaula Lumpur in December 2019. Since the Saudis are particularly sensitive about any move that might undermine its leadership of the 57-member pan-Islamic body, it saw the development as a challenge to the OIC.

Pakistan eventually pulled out of the summit at the last minute under pressure from Riyadh and the UAE. When former Prime Minister Imran Khan was removed from office in early April by a parliamentary vote of no-confidence instigated by his opposition, sentiments began to change.

Consequently, when Pakistan’s new Prime Minister Shehbaz Sharif traveled to Riyadh at the beginning of November, the Saudis revived the project that had been shelved under Khan’s premiership.

The Pakistani government was quite optimistic about MbS’s trip to finalize the massive investment contract earlier this month; however, the visit was once again postponed by Saudi authorities.

Gwadar’s geopolitical significance

As part of Beijing’s multi-trillion dollar Belt and Road Initiative (BRI), China is constructing Gwadar Port on the Pakistani side of the volatile Balochistan province. Pakistan has handed over the port on a 40-year lease to the China Overseas Port Holding Company (COPHC), a government-run Chinese enterprise.

The key Gwadar port’s activities, including its development operations in the Arabian Sea, will be managed by COPHC, according to the terms of the leasing agreement between China and Pakistan. The COPHC owns 91 percent of the anticipated gross revenue from the terminal and marine activities in addition to 85 percent of the port’s gross revenue.

The Gwadar port is of strategic importance for China because it serves as a hub for the $68 billion China-Pakistan Economic Corridor (CPEC). The port will reduce the current forty-day journey from the Persian Gulf to the Chinese border to just seven days.

Iran and Saudi Arabia’s rivalry aside, it is China that stands to gain the most, as both countries – in addition to traditional ally Pakistan – are all keen to expand their relations with Beijing and join or further integrate into BRICS and the Shanghai Cooperation Organization (SCO).