The Return of Beijing’s Dubious Economic Growth Targets

For most of the past four decades, economic development has been the Chinese government’s lodestar. The Chinese Communist Party (CCP) has implicitly justified its rule by pointing to expansive growth. Indeed, since the Chinese leadership first unveiled an annual growth target, in 1985, the target has essentially been met or exceeded each year, except in 1989.

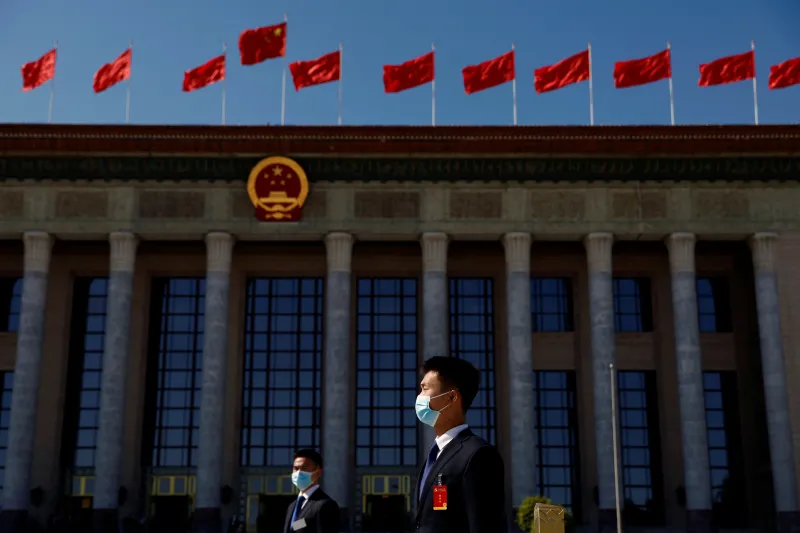

There was once a good reason for this practice: it offered the CCP a way to encourage lower-level officials to pursue development at a rapid but manageable rate. But over time, hitting the annual target fueled wasteful spending that produced unsustainable debts, empty buildings, and excessive pollution. After COVID-19 upended the global economy, the government did not set standard growth targets in 2020 and 2021. The break offered a chance to move away from this outmoded practice and adapt to the more complex reality of China’s twenty-first-century economy. But in March 2022, the Chinese government once again announced an annual target: 5.5 percent, an ambitious number it is not likely to meet. The fact that the Chinese government delayed the release of economic data as scheduled this October hints that Xi is struggling to balance a pure focus on development with a desire to achieve more equitable growth.

CASTLES IN THE SKY

Chinese President Xi Jinping has articulated a vision of a green economy that is equitable, innovative, and service oriented. And he wants to wean the country’s economy from speculative real estate investment as its primary growth engine. But these aims will be hard to achieve.

Last year, Xi announced a slew of new regulations on the Chinese technology sector, with a goal of reigning in the power of this growing part of the economy. This shook investor confidence, sparking losses beyond $1 trillion while failing to significantly redistribute resources or improve equality. A likely impetus for reinstituting the GDP target was to signal to investors, bureaucrats, and the public that, despite Xi’s moves, China remained committed to growth.

The Chinese government, however, has not done everything in its power to hit the target. Take China’s “zero COVID” policy, which aims to keep infection rates down by mandating quarantines and instituting stringent controls on those who contract the virus or come into contact with it. The approach produced enviable results with respect to the health of the Chinese population throughout 2020 and 2021: official statistics place the death count below 5,300. Although the Chinese data may not be entirely reliable, anything close to that figure is impressive. Florida alone saw more than 63,000 deaths from COVID-19 over those two years, about 12 times the Chinese number. Zero COVID has, however, blighted the Chinese economy.

Xi is struggling to balance a focus on development with a desire to achieve more equitable growth.

There were indications at the beginning of the year that the Chinese leadership could be on the verge of relaxing its zero-COVID approach. That changed with the emergence of the very contagious Omicron variant: an explosive outbreak in Shanghai killed hundreds of residents, leading the government to mandate an eight-week lockdown that left many households without food or access to medical care. This nightmare led mayors around the country to mandate lockdowns at the first signs of exposure in their cities. Economic activity flatlined, producing essentially zero growth in the second quarter of 2022. In essence, China’s zero-COVID measures have been a catastrophic success, protecting millions of lives but wrecking the country’s economic engine in the process.

Exiting zero COVID will be neither simple nor costless. With low levels of inoculation and the questionable efficacy of Chinese vaccines, opening up will bring significant health consequences. The scale of death could be vast; over a million people could succumb to the virus in just a few months. There will be political fallout as well. Consider the public outcry after Li Wenliang—the doctor who issued an early alarm online about COVID-19 in December 2019, drawing the ire of Chinese authorities—died of COVID in February 2020. The Chinese government’s success in keeping the case count low while deaths skyrocketed abroad helped quell the outrage. If Chinese leaders were to adopt looser policies and hundreds of thousands were to die as a consequence, the Chinese public is likely to again erupt in anger, particularly given that most other countries seem to have settled into a post-COVID-19 new normal.

Similarly, the Chinese real estate slowdown is partially the result of a policy choice. The government is trying to bring housing prices down to affordable levels and simultaneously preserve the valuations of assets that are the core of Chinese household wealth. This requires delicate balancing of a $50 trillion market where expectations play a huge role. The need for prompt action, however, is evident. Tens of millions of housing units stand empty. Millions more remain unbuilt. Many would-be home buyers paid for units before their construction, and developers have squandered these funds, leading a growing number of buyers to stop mortgage payments on homes that may never be completed. Xi has indicated his desire to see property taxes play a key role in transforming the complicated nexus of local government finances and speculative investments, but strong resistance has kept its expansion beyond a few pilot cities.

NOT ENTIRELY OF ITS OWN MAKING

Besides suffering from the consequences of its own government’s policies, the Chinese economy has been buffeted by forces far beyond China’s borders. The war in Ukraine has led to high energy and food prices across the globe, increasing China’s import bill and dampening demand for Chinese exports. Central banks in many countries have raised interest rates to tame inflation, a move that heightens the risk of capital flight out of China. In addition, the expansion of U.S. restrictions on exporting technology to China threatens its efforts to create an innovative economy.

Structural problems abound in the Chinese economy. The narrow focus on growth that propelled the country for decades was starting to lose its efficacy when Xi came to power. Problems such as corruption, pollution, and mounting debts festered. Xi’s consolidation of power shook a staid CCP system, personalizing authority and demanding silent obedience. But as much as this move resolved some political problems, it also produced inept policymaking and poor economic performance.

Failing to meet the GDP growth target will not be the end of Xi or the CCP. Authoritarian governments in general often have real support; this is particularly true in China. Moreover, the country’s low death rate from COVID-19 provides a compelling justification for low growth, even if the zero-COVID policy is increasingly frustrating for the Chinese people to live under.

That said, youth unemployment is at record highs. Developers’ debts are coming due. Many projects that seemed likely to accrue value over time are being revealed as holding little real worth.

The government will need to deal with the debt accumulated by developers and local governments that have overbuilt infrastructure and engaged in real estate speculation. Rather than routing stimulus through corporations, the central government needs to give money directly to the Chinese people to increase consumption and shift the economy away from investment. The economic and political tests that the country faces demand nuanced solutions and tradeoffs between competing values and constituencies. Failing to hit the GDP target merely hints at the magnitude of the hard work that lies ahead.